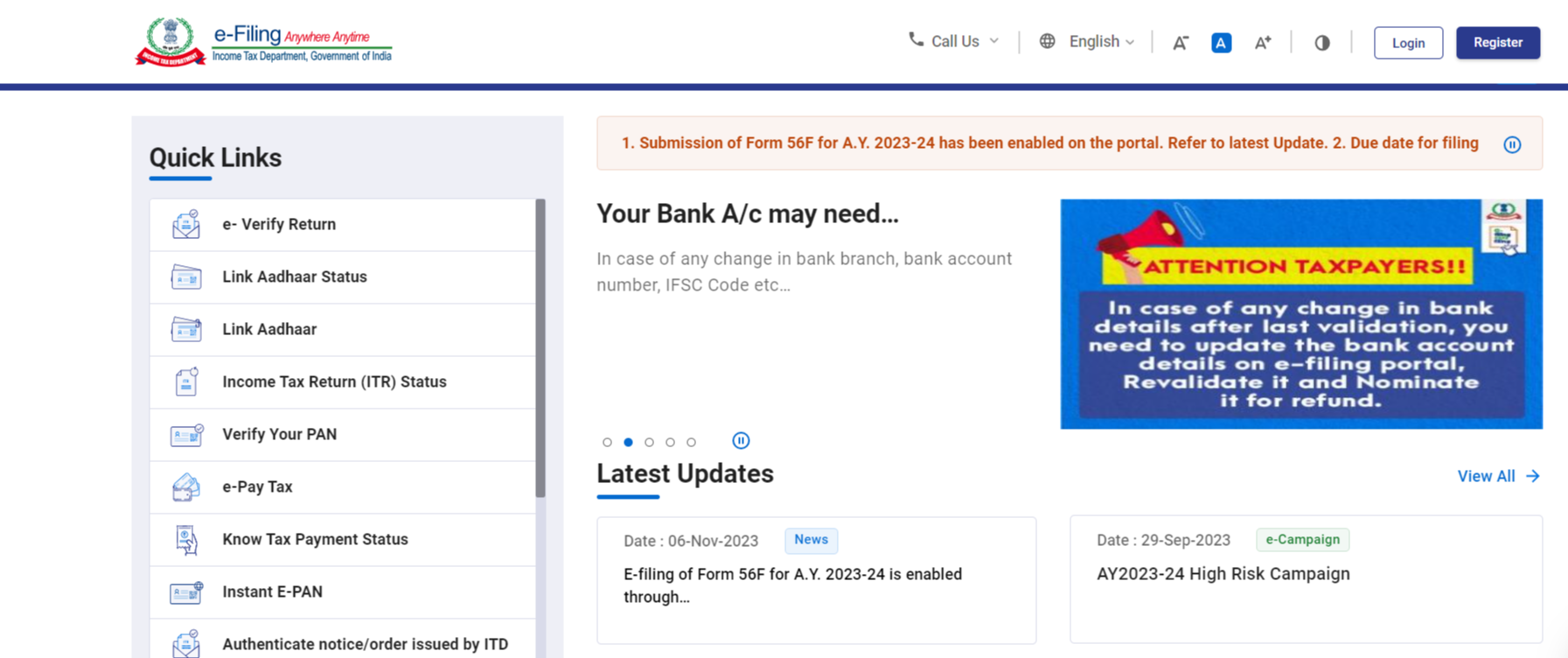

www.incometax.gov.in Login – Eportal Income Tax {ITR} Refund Status 2024-25 [e filing 2.0]. Applicants can check their ITR status through Pan Card.

Income Tax Refund Status – The Department of Income Tax has made an online portal to fill out Eportal Income Tax Returns. It is an online mode. Applicants have to log in under official website. In below article, we will provide all details regarding this portal.

Eportal Income Tax (ITR) Status

Income Tax is a document that individuals and businesses file with government to report their income and calculate amount of tax. It is an important part of tax process and it helps government to determine the tax liability of individuals. It is an online portal. Applicants need to register themselves with a username and password.

Filling income tax returns ensures that individuals and businesses comply with tax laws of their respective countries. ITR Refund Portal applies to individuals who are residents, have salaries from jobs, and have one-house properties. It is related to individuals with relatively simple financial situations. Candidates can apply online mode. For further details go through the below article.

Basic Information for Eportal Income Tax Refund Status

| Title | Eportal Income Tax{ITR} Refund Status |

| Department | Income Tax Department |

| Category | Refund Status |

| Mode | Online |

| Also known as | IT |

| Year | 2024-25 |

| Login Details | * Username * Password |

| Date to Filling ITR 2024 | 31st December 2024 |

| Country | India |

| Language | English |

| Official Website | www.incometax.gov.in |

आईटीआर रिफंड स्थिति 2024-25 – www.incometax.gov.in

यह आयकर विभाग, भारत सरकार का एक आधिकारिक पोर्टल है। इस पोर्टल को राष्ट्रीय ई-गवर्नेंस योजना के तहत एक मिशन मोड परियोजना के रूप में विकसित किया गया है। इस पोर्टल का उद्देश्य करदाताओं और अन्य हितधारकों के लिए आयकर संबंधी सेवाओं के लिए सिंगल विंडो एक्सेस प्रदान करना है। उम्मीदवार जो कार्यालयों और नौकरियों में काम कर रहे हैं उन्हें अपना आयकर रिटर्न भरना होगा। वे ऑनलाइन मोड के माध्यम से अपनी स्थिति की जांच कर सकते हैं। अधिक जानकारी के लिए नीचे दिए गए लेख को देखें।

Benefits of Income Tax Refund Status

- Free Income Tax Returns{ITR}.

- It is taxpayer-friendly and easy to use.

- Manage past tax returns.

- They can download tax-related documents.

- Verify e-Filed Returns.

Services Provided Under ITR

- Account misuse

- Verify your Pan Card

- Link Aadhaar

- Tax details and services.

- Instant E-PAN

- Income tax calculator

- Income Tax Return

- Check your AO

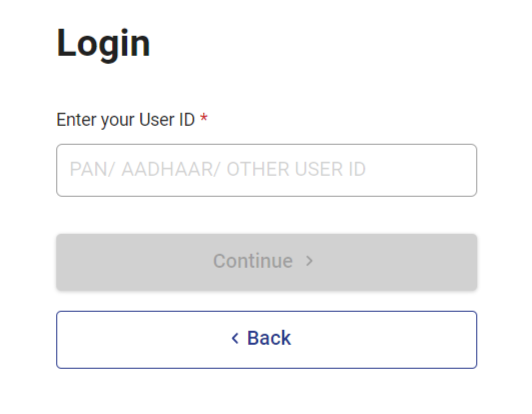

How to Login ITR Refund Status

- Open official website through www.incometax.gov.

- On homepage, Income Tax Department will open on your screen.

- Click on the login section.

- Enter required details such as username and password.

- Now click on submit button.

- At last, take a printout for further issues.

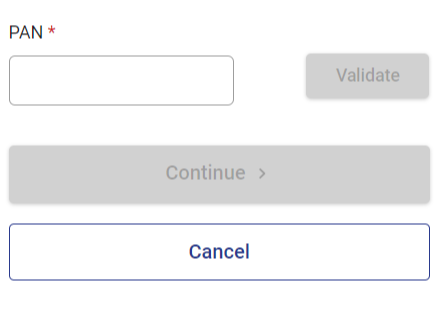

Steps to Log in with PAN Card

- Visit official website of income tax e-filling portal – www.incometax.gov.in.

- On homepage, click on login button.

- Enter your Pan card number and click on continue.

- Then confirm your number with a message.

- Enter your password and click on submit.

- Now you will be redirected to your page.

Helpline details of e-filing and Centralized Processing Center

| Contact Number | 1800 103 0025 |

| Email Address | [email protected] |

| Official Website | www.incometax.gov |

- Eportal Income Tax (ITR) Status

- Basic Information for Eportal Income Tax Refund Status

- आईटीआर रिफंड स्थिति 2024-25 – www.incometax.gov.in

- Benefits of Income Tax Refund Status

- Services Provided Under ITR

- How to Login ITR Refund Status

- Steps to Log in with PAN Card

- Helpline details of e-filing and Centralized Processing Center