Traces Registration India, Insight Income Tax Payer Login – Income Tax Reporting Portal Login, Calculator Ay 2024-25, Tax Slab

Check Traces Registration Portal India

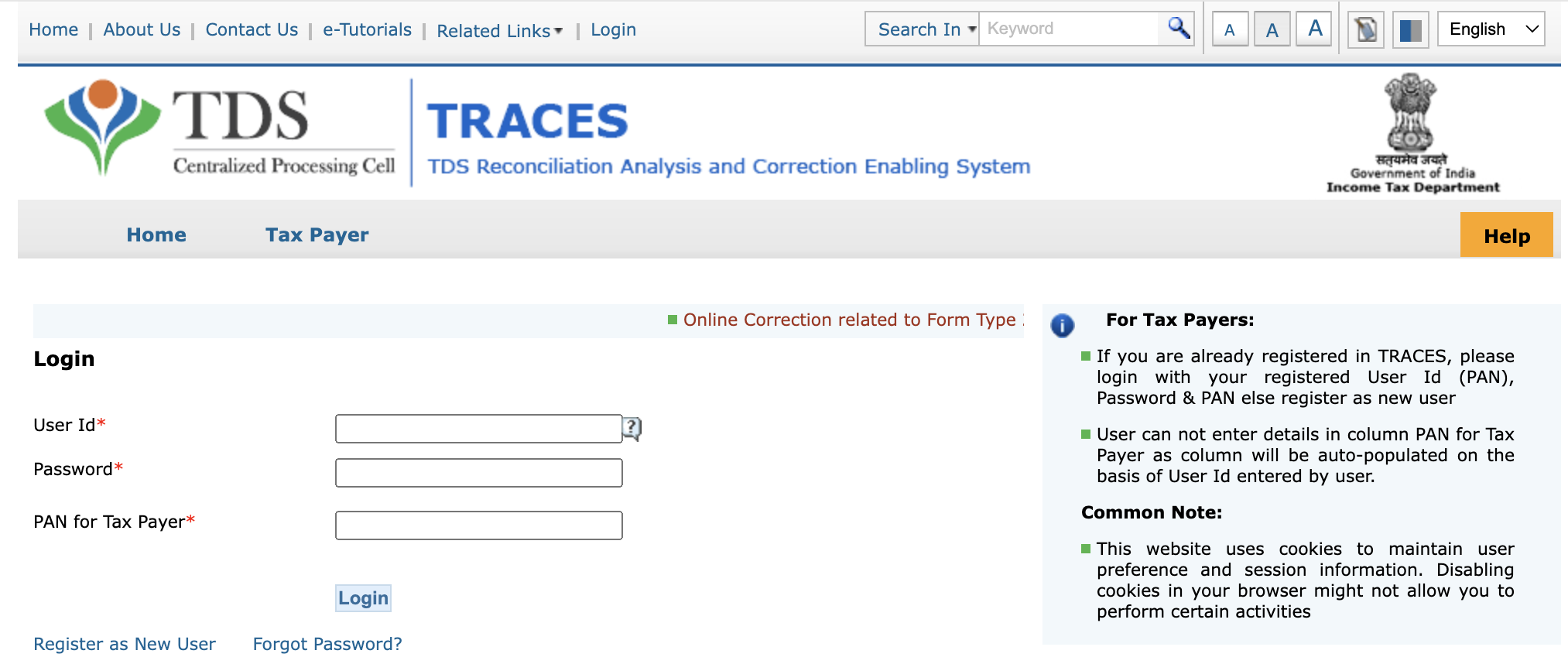

Traces Registration India offers a comprehensive platform for taxpayers to register and manage their income tax-related activities seamlessly. Through the Insight Income Tax Payer Login, individuals and businesses gain access to the Income Tax Reporting Portal, enabling them to fulfil their tax obligations efficiently. This portal facilitates easy submission of tax returns, viewing of tax credits, and tracking of tax refunds. Additionally, users can utilise the Calculator for Assessment Year (AY) 2024-25 to compute their tax liabilities accurately. With detailed information on tax slabs and deductions, Traces Registration India empowers taxpayers to navigate the complexities of income tax compliance with ease.

If someone earns less than the amount where they have to pay taxes, they don’t have to fill out tax forms. But if they earn less than Rs 2.5 lakhs (old rules) or Rs 3 lakhs (new rules) and want to get back any taxes they paid, they can still fill out tax forms to claim that money. Otherwise, they have to fill out tax forms no matter what.

In this article we will know ;

- Recent Note for tax payers.

- What is Income Tax Calculator ?

- How to Use the Income Tax Calculator for FY 2024-25 (AY 2025-26) ?

- How to Calculate Income Tax ?

- Example : Income Tax Calculation for the Salaried

- To calculate income tax, include income from all sources

- Old Regime Non-Taxable Income Limit

- Exemptions / Deductions Disallowed Under New Tax Regime

- Allowances Allowed Under New Tax Regime

- Details you need when you’re e-filing your income tax returns

To calculate income tax, include income from all sources :

Income from Salary : Include salary paid by your employer.

Income from House Property : Add any rental income or include interest paid on home loan.

Check Income from Capital Gains : Include income from the sale or purchase of shares or a house.

Income from Business / Profession : Include income from freelancing, a business, or a profession.

Income from Other Sources : Include savings account interest income, fixed deposit interest income, and interest income from bonds.

ABC’s Investments and Deductions under the Old Tax Regime :

- PPF Investment : Invested Rs 50,000 in PPF.

- ELSS Purchase : Purchased ELSS worth Rs 20,000 during the year.

- LIC Premium : Paid LIC premium of Rs 8,000.

- Medical Insurance : Paid medical insurance premium of Rs 12,000.

| Section – Maximum Deduction | Eligible Investments / Expenses – Amount Claimed by ABC | ||

|---|---|---|---|

| 80 C – Rs. 1,50,000 | PPF deposit Rs 50,000, ELSS investment Rs 20,000, LIC premium Rs 8,000, EPF contribution (ABC’s) Rs 1,44,000 – Rs. 1,50,000 | ||

| 80 D – Rs. 25,000 for self, Rs. 50,000 for parents | Medical insurance premium Rs. 12,000 – Rs. 12,000 | ||

| 80 TTA – Rs. 10,000 | Savings account interest Rs. 8,000 – Rs. 8,000 |

Old Regime Non-Taxable Income Limit :

-

- Maximum non-taxable income: Rs. 2.5 lakh

- Rebate under section 87A:

- FY 2018-19: Rs. 2,500 for total income up to Rs. 3.5 lakh

- FY 2019-20 onwards: Increased to Rs. 12,500 for income up to Rs. 5 lakh

- Tax-free income with investments under section 80C: Up to Rs. 6.5 lakhs

-

Budget 2023 – New Regime :

- Maximum non-taxable income: Rs. 3 lakh

- Rebate under section 87A: Rs. 25,000 for total income up to Rs. 7 lakh

- Tax-free income under old regime: Rebate limit remains at Rs. 5 lakhs

Income tax calculated for ABC under the new tax regime :

| Income Range – Tax Rate | Tax Amount | |

|---|---|---|

| Up to Rs 3,00,000 – Exempt from tax | 0 | |

| Rs 3,00,000 to Rs 6,00,000 – 5% | Rs 15,000 | |

| Rs 6,00,000 to Rs 9,00,000 – 10% | Rs 30,000 | |

| Rs 9,00,000 to Rs 12,00,000 – 15% | Rs 45,000 | |

| Rs 12,00,000 to Rs 15,00,000 – 20% | Rs 60,000 | |

| More than Rs Rs 15,00,000 – 30% | Rs 1,62,600 | |

| Cess – 4% of total tax | Rs 12,504 | |

| Total Income Tax : Rs 15,000 + Rs 30,000+ Rs 45,000 + Rs 60,000 + Rs 1,62,600 + Rs 12,504 | Rs 3,25,104 | |

Income Slab and Applicable Tax Rate :

Details you need when you’re e-filing your income tax returns :

Basic Information : Includes PAN, Aadhar Card details, and current address.

Bank Account Details : All accounts held during the financial year.

Income Proofs : Current salary details, income from investments (e.g., FDs, savings bank account), etc.

Deductions Claimed : Under Section 80 or Chapter VI-A.

Tax Payment Details : Includes TDS and advance tax payments.

OFFICIAL WEBSITE >> Income Tax Reporting Portal >> nriservices.tdscpc.gov.in /nriapp/ login.xhtml

- Check Traces Registration Portal India

- In this article we will know ;

- For Taxpayers :

- Common Note :

- Income Tax Calculator :

- How to Use the Income Tax Calculator for FY 2024-25 (AY 2025-26) ?

- How to Calculate Income Tax ?

- Example : Income Tax Calculation for the Salaried

- To calculate income tax, include income from all sources :

- Old Regime Non-Taxable Income Limit :

- Budget 2023 – New Regime :

- Exemptions / Deductions Disallowed Under New Tax Regime :

- Income Slab and Applicable Tax Rate :

- Allowances Allowed Under New Tax Regime :

- Details you need when you’re e-filing your income tax returns :

- OFFICIAL WEBSITE >> Income Tax Reporting Portal >> nriservices.tdscpc.gov.in /nriapp/ login.xhtml

No

Yes