enps.nsdl.com registration login – National Pension System 2024 – Check NPS Features, Benefits, Eligibility, Documents, How to Apply, Types, Steps to Login, Registration, etc. Interested citizens of India can apply under this system for a better future. To know more about this go through the below article.

NSDL e-Gov Now “Protean”

Important Points of National Pension System

- The National Pension System provides old age income.

- It extends old-age security coverage to all citizens of India.

- This gives reasonable market-based returns over the long term.

- Citizens must have their mobile number, email ID, and bank account.

- Indian citizens must be between 18 to 70 years old can apply under this scheme.

- You can change your pension fund manager annually.

- Candidates must be an Indian Citizen to apply under this system.

- Subscribers of NPS can open their account online mode.

- NPS pension scheme is open for all public, private, and unorganized sectors.

National Pension System Registration 2024

National Pension System {NPS} is known as the contribution pension system in India regulated by Pension Fund Regulatory and Development Authority {PFRDA}. Official Website of Nps : enps.nsdl.com it comes under jurisdiction of Ministry of Finance of the Government of India. NPS was established by PFRDA as per provisions of the Indian Trusts Act of 1882 to take care of this scheme for the best interest of people. Its main purpose is to provide a defined contribution-based pension for retirees and old age security coverage to all citizens. This scheme is designed for citizens of India only.

NPS was started for all citizens of India in 2009. It was created for a pension society in India. Under this scheme, citizens can choose their investment options and can check their pension fund. Those people who come under the age of 18 years to 70 years can apply under this scheme. There are different sectors available for NPS like Government sector, the Private sector, etc. If you open your NPS account you will get many advantages as compared to other pension schemes. Through this scheme, you will get low-cost products, easily portable, market-linked returns, etc. For further details, you need to scroll down the below page or Visit enps.nsdl.com.

Highlights of National Pension System

| Scheme | National Pension System |

| Session | 2024 |

| Founded in | 1st January, 2004 |

| Type | Pension Investment Scheme |

| Objective | Provide defined-contribution-based pension for old age and retires |

| Headquarters | New Delhi |

| Also known as | NPS |

| Mode | Online |

| Helpline Number | 022 2499 3499 |

| Official Website | enps.nsdl.com |

राष्ट्रीय पेंशन प्रणाली लाभ 2024

राष्ट्रीय पेंशन प्रणाली कम लागत और अच्छी तरह से विनियमित स्वैच्छिक सेवानिवृत्ति लाभ योजना है। इस योजना के तहत लोग वित्तीय वर्ष में किसी भी समय योगदान कर सकते हैं और राशि में बदलाव भी कर सकते हैं। नागरिक अपने स्वयं के निवेश विकल्प और पेंशन फंड चुन सकते हैं। वे कहीं से भी खाते संचालित कर सकते हैं। एनपीएस को पारदर्शी निवेश मानदंडों और नियमित निगरानी के साथ पीएफआरडीए द्वारा विनियमित किया जाता है। यह योजना केवल भारत के उन नागरिकों के लिए लागू है जिनकी आयु 18 वर्ष से 70 वर्ष के बीच है। अधिक जानकारी के लिए नीचे दिए गए लेख को पढ़ें।

Eligibility Criteria Required for NPS Scheme

- Citizens must be an Indian.

- Candidates who are between 18 years to 70 years old are applicable.

- People of Indian Origin and Hindu Undivided Families are not eligible.

- Under this scheme old age people also get security.

Documents Required for National Pension System

| Mobile Number |

| Email Address |

| Bank Account |

| Passport Size Photo |

| Aadhar Card |

| Address Proof |

| Birth Certificate |

| Income Certificate |

Types of Accounts Under National Pension System

- Tier 1 Account –

This is a permanent retirement account under which regular contributions made by subscribers or employees and they are credited and invested as per the scheme manager chosen by you. Minimum contribution to open this account is Rs.500/-.

- Tier 2 Account –

This is a voluntary withdrawable account which is allowed if you have an active Tier 1 account. You can withdraw your money at any time from this account. It provides you a greater flexibility. Under this separate nomination facility is available.

Top 7 Fund Managers for National Pension System Scheme

- HDFC Pension Managment

- Kotak Mahindra Pension Fund

- ICICI Prudential Pension Fund

- SBI Pension Funds

- UTI Retirement Solutions

- LIC Pension Fund

- Aditya Birla Capital

Key Points Regarding NPS 2024

- Regular Pension to all subscribers.

- Reliable Retirement Corpus to all citizens.

- Market-based long-term investment scheme.

- NPS scheme enables a tax benefit of up to 2 lakh.

- Under this scheme, we can check funds.

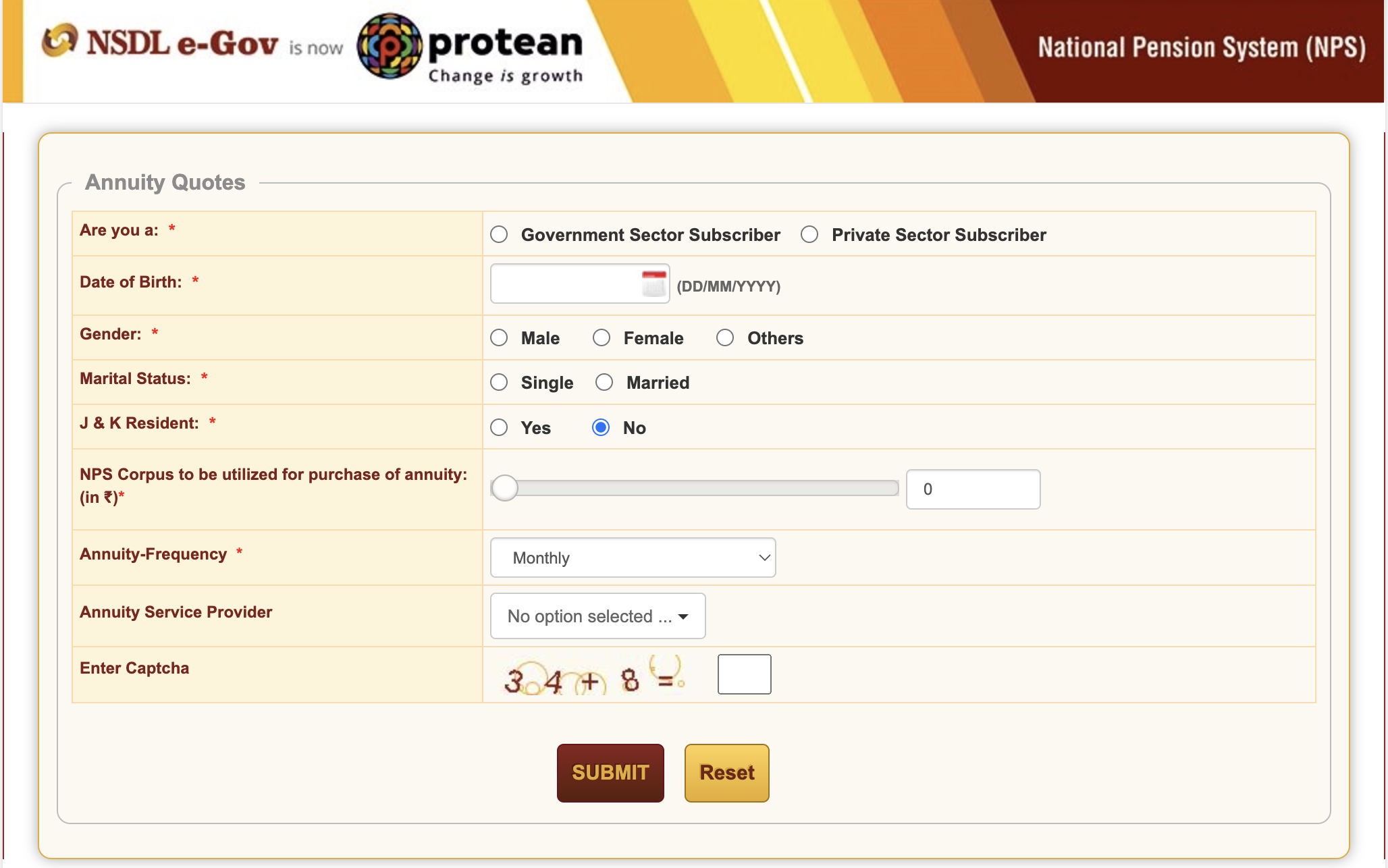

Steps to Online Registration Under NPS 2024

- You must have your12 12-digit PRAN [Permanent Retirement Account Number] to log into your NPS account. Submit your all required documents on NSDL website to avail of your PRAN.

- After this, you need to visit official website of NPS.

- Enter your User ID, Captcha Code, Password, etc.

- Then a IPIN will generated which you can use logging into NPS Portal.

- Now log in to NPS page and click on PRAN/IPIN.

- At last use your PRAN/IPIN number to sign into NPS account.

How to Check NPS Balance Online

- Visit official website of National Pension System – enps.nsdl.com.

- A new page will open in front of you.

- Enter your PRAN user ID and password to log in.

- Click the login button, then click on Transaction statement option.

- After this, you can download your Holding statement as well as your transaction statement.

Contact Details of National Pension System

| Address Protean eGov Technologies Limited 1st Floor, Times Tower, Kamala Milla Compound, Senapati Bapat Marg,Lower Parel, Mumbai-400 013 | |

| Phone Number – 1800 2100 080 | |

| Official Website : cra-nsdl.com |

- NSDL e-Gov Now “Protean”

- Important Points of National Pension System

- National Pension System Registration 2024

- Highlights of National Pension System

- राष्ट्रीय पेंशन प्रणाली लाभ 2024

- Eligibility Criteria Required for NPS Scheme

- Documents Required for National Pension System

- Types of Accounts Under National Pension System

- Top 7 Fund Managers for National Pension System Scheme

- Key Points Regarding NPS 2024

- Steps to Online Registration Under NPS 2024

- How to Check NPS Balance Online

- Contact Details of National Pension System