Key Points About icegate login for Custom Duty Online Payment, Sea Igm (iec) Status, Exchange Rate

- Users of ICEGATE have access to the papers they have uploaded.

- A user-friendly online portal for checking Sea IGM (IEC) status, paying customs duties, and finding exchange rates is offered by ICE GATE.

- When you sign up for the service, you have two choices:Proceed with the use of Reference ID; Fresh Registration – No Reference ID.

Official Website to icegate login for Custom Duty Online Payment, Sea Igm (iec) Status, Exchange Rate 2024 Check Online. Link to Icegate Portal 2024

icegate login for Custom Duty Online Payment, Sea Igm (iec) Status, Exchange Rate

ICE GATE provides a convenient online platform for customs duty payment, tracking Sea IGM (IEC) status, and accessing exchange rates. This portal offers a user-friendly interface for businesses and individuals engaged in import and export activities, streamlining the customs clearance process. By logging into ICEGATE, users can efficiently manage their customs-related transactions, monitor the status of their Sea IGM ( Importer Exporter Code ), and stay updated on exchange rates, ensuring compliance and facilitating seamless international trade operations.

Summary About ICEGATE :

- Registering for the service offers two options

- Log in to ICEGATE

- Steps for electronic filing on the ICE GATE website

- Services Offered by ICE GATE

- Process for GSTIN integration automation

-

Steps to pay via NEFT / RTGS for CE / ST

- ICEGATE – Portal and its Roles

- IEC GSTIN Mapping Advisory

- Child User Registration Process on ICEGATE 2.0

- e-Sanchit Application Process Guide

Registering for the service offers two options :

- Continue using Reference ID : Choose this option if you already have an unexpired Reference ID.

- Fresh Registration – Don’t have Reference ID : Opt for this option if you don’t possess a Reference ID or if your Reference ID has expired.

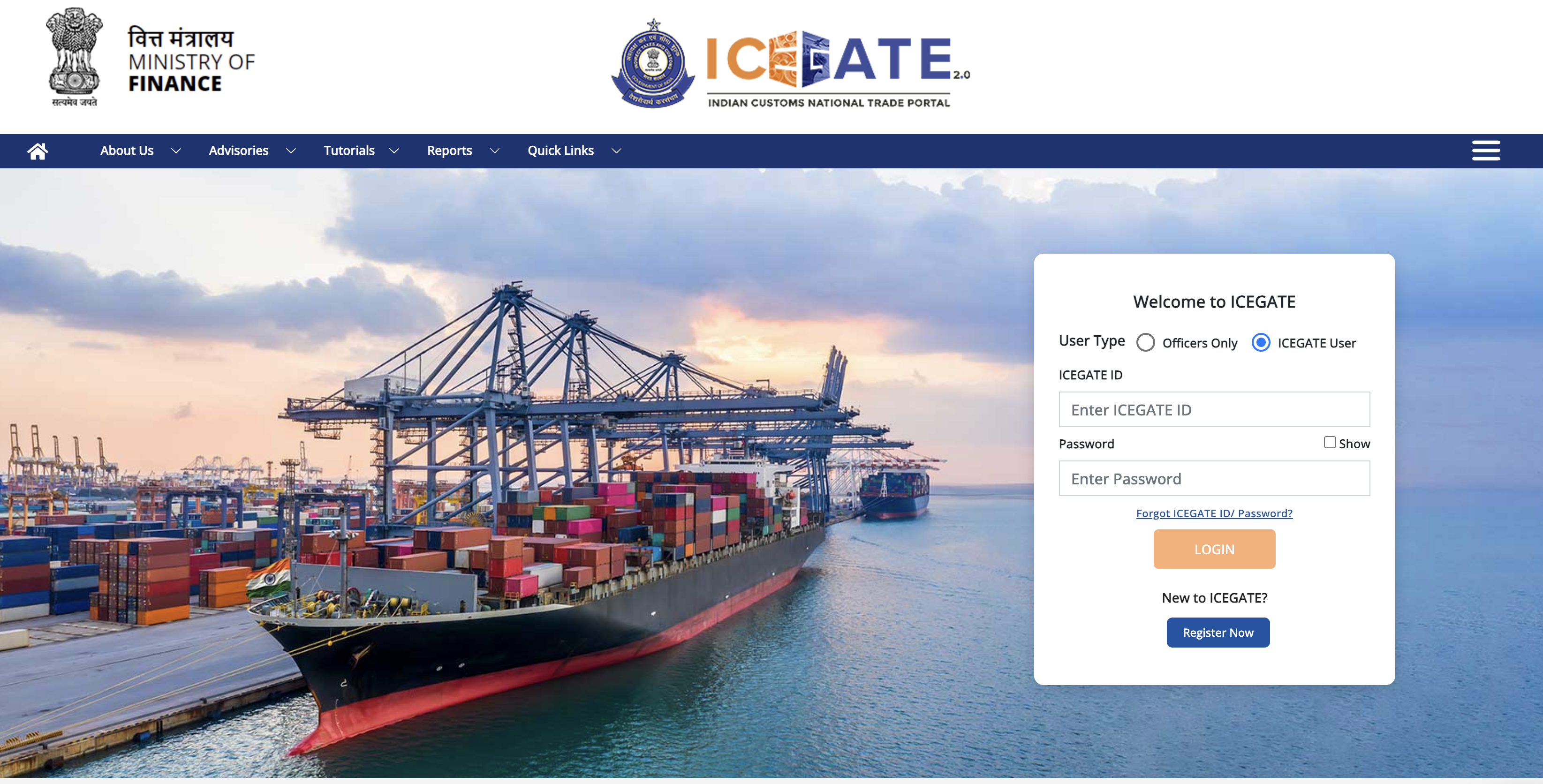

Log in to ICEGATE :

- ICEGATE users can log in using their ICEGATE ID and Password.

- New users need to register by clicking on the “Register Now” link.

- Registration is only available for ICEGATE users, not CBIC Officers.

- During registration, trade users provide basic details.

- The system approves selected ICEGATE ID and Password for login purposes.

Steps for electronic filing on the ICE GATE website :

- Access the ICE GATE website and log in to your account using your credentials.

- Find and select the “Electronic Filing” section on the website.

- Depending on your requirement, select the appropriate filing option from the available choices.

- Enter the required information and complete the necessary fields as per the filing instructions.

- Upload any necessary documents or files required for the filing process.

- Double-check all the information provided for accuracy and completeness.

- Once satisfied, submit the electronic filing through the designated button or option on the website.

- After submission, wait for a confirmation message or notification indicating that your filing has been successfully received.

- Optionally, you can track the status of your filing through the website to monitor its progress.

Services Offered by ICE GATE :

Registration

- IEC/CB Registration

- ECCS

- SEZ Registration

- Registration Verification

- GSTN Integration

- IEC GSTIN Mapping

- AD Code Bank Account Registration

Examination

- Examination Application for Custodians

- Examination Application – Advisory for Importers, Authorized Custom Brokers

Electronic Filing

- Filing Using RES Package

- Filing Using Service Centre

- Filing Using SMTP/E-mail

- Filing Using Third Party Applications

- Filing Using Webform

- Filing Using Web Upload

- Using Webforms

- Using SMTP/Email

- Air Transshipment

- BE Query Reply

- e-Sanchit

Goods Registration

- MFTP

- Advisory regarding Check introduced for Nature of Contract in SB Filing

- Using Digital Signature Certificate

E-Payment

- Electronic Cash Ledger (ECL)

- NEFT/RTGS Payment for CE/ST

- SEZ Online Duty Payment

- Customs (Waiver of Interest)

- Authorized Banks for E-Payment

PAN Merger

- E-Script

- E-Scrip to Avail Export Incentive Schemes (RoSCTL, RoDTEP)

SCMTR

- Message Implementation Guide

- Utilities for SCMTR Messages

- Declaration of Crew Effect, Ship Store and Persons Details in the New SCMTR Application

- Message Filing

- Message Filing Guidelines

IGCR

- IGCR for Importers

- IGCR advisory regarding Release of Bond and Bank Guarantee

Miscellaneous Advisories

- Taxpayer Grievance App-AEM

- Custodian

- Machine Release of Goods

- Search BoE & Query ICEGATE at GST portal

- SB EDPMS Enquiry

- Mandatory declaration of warehouse code and modification in ACB role

- Communicating with ICEGATE

- Advisory for CAVR Order for Stainless Steel of J3 Grade

- Java Setup for DSC Upload

User Manual

- Enquiry Module

- Webforms

- Login Dashboard

- Main Website

- Chatbot

- Self Help Facility

- Child User Creation

- Document Download utility

Customer Support

- Lodge Grievances

- Helpdesk

- Track Filing

- Post Login Enquiries

- Public Enquiries

Resources

- Compliance Information Portal (CIP)

- Customs Duty Calculator

- Advisories

- Self Help Webform

- Automated Escalation Module.

Process for GSTIN integration automation :

- Go to ICEGATE homepage and navigate to Services >> Registration.

- Choose the option for integrating GSTIN with customs.

- Input the GSTIN number and Captcha, then click Submit.

- After successful submission, the GSTIN will be registered with customs.

- Allow 24 hours for the integration to reflect on the customs system.

Steps to pay via NEFT / RTGS for CE / ST :

| Role | Widgets on Dashboard |

|---|---|

| Airline | Profile Status, Ticket Management, Admin Notifications, Services |

| Authorized Terminal Operator | Profile Status, SCMTR Enablement, Ticket Management, Admin Notifications, Services, Team Management |

| Consol Agent | Profile Status, SCMTR Enablement, Ticket Management, Admin Notifications, Services |

| Custodian | Profile Status, Ticket Management, Admin Notifications, Services, SCMTR Enablement, Team Management |

| Customs Broker | Profile Status, Ticket Management, Admin Notifications, Services, Challans Generated, SCMTR Enablement, Team Management, My IEC, Bill of Entry – Job Status, Shipping Bill – Job Status |

| CTO (Container Train Operator) | Profile Status, Ticket Management, Admin Notifications, Services, SCMTR Enablement |

| eSeal Vendor | Profile Status, Ticket Management, Admin Notifications, Services |

| Freight Forwarder | Profile Status, Ticket Management, Admin Notifications, Services, SCMTR Enablement |

| Importer/Exporter | Profile Status, Ticket Management, Admin Notifications, Services, Challans Generated, License Details, Foreign Remittances, SCMTR Enablement, Bond & BG, Drawback, IGST Refund, Team Management, My CHA, Bill of Entry – Job Status, Shipping Bill – Job Status, eScrip |

| NVOCC | Profile Status, Ticket Management, Admin Notifications, Services, SCMTR Enablement |

IEC GSTIN Mapping Advisory :

- Access the IEC GSTIN Mapping functionality on the ICEGATE homepage under Services > Registration > For Matching IEC GSTIN.

- Click on the highlighted link to proceed with mapping.

- Provide the IEC Number and GSTIN Number along with the Captcha, then click Submit.

- Upon successful submission, a message confirming the update will appear, indicating that it may take up to 24 hours to reflect.

- If the GSTIN is not integrated with customs, a message will advise to integrate it first.

- Follow the advisory for integrating GSTIN with customs for further guidance.

Child User Registration Process on ICEGATE 2.0 :

I. Creation of Reference ID by Parent User

- Log into ICEGATE 2.0 portal

- Access ‘Add New Child User’ under the profile section

- Generate Reference ID for child user registration

II. Completion of Registration Form by Child User

III. Approval/Rejection by Parent User : Parent user (Admin for CHA child users) approves or rejects child user registration

Prerequisites for Child User Registration :

- Go to ICEGATE login page

- Select ‘ICEGATE User’ as User Type

- Enter ICEGATE ID and Password

- Click ‘Login’ button

Steps for Parent User :

- Access profile section by clicking ‘Complete Your Profile’ link

- Click ‘View Your Profile’ to display user profile

- Amend profile parameters if desired

- Click ‘View Tickets’ link to show tickets created in the last 30 days

eSanchit Application Process Guide :

Step 1: Prepare Supporting Documents in Digital Format

- Ensure the document is in PDF/A format (ISO 19005-2).

- Obtain PDF/A format directly from the document issuer if possible.

- If not possible, scan the document with recommended quality aspects.

- Preview the document for clarity and legibility.

- Digitally sign the PDF document using the registered digital signature certificate on ICEGATE.

Step 2: ICEGATE Login

- Only registered taxpayers with a digital signature certificate on ICEGATE can upload documents.

- Sign in to ICEGATE portal.

3rd Step : Access eSanchit

- Under the relevant role tab, click on eSanchit under the Services widget.

Step 4: Upload Document

- Click on the Upload Document button.

- Select single or multiple documents (up to 5) adhering to size and type restrictions.

- Choose the document type for each selected document.

5th Step : Select Document Type

- System prompts the user to choose the document type from a dropdown list.

Step 6: Submit Document to Generate IRNs

- Click on the Submit button to generate IRNs.

- Accept the disclaimer popup to proceed with IRN generation.

- Unique IRN will be displayed on the webpage and sent via email.

- Incorporate the IRN into the system of records.

Viewing Uploaded Documents

- ICEGATE users can view the documents uploaded by them.

OFFICIAL WEBSITE >> ICE GATE Portal >> icegate.gov.in

- Key Points About icegate login for Custom Duty Online Payment, Sea Igm (iec) Status, Exchange Rate

- icegate login for Custom Duty Online Payment, Sea Igm (iec) Status, Exchange Rate

- Summary About ICEGATE :

- Registering for the service offers two options :

- Log in to ICEGATE :

- Steps for electronic filing on the ICE GATE website :

- Services Offered by ICE GATE :

- Process for GSTIN integration automation :

- Steps to pay via NEFT / RTGS for CE / ST :

- ICEGATE – Portal and its Roles :

- IEC GSTIN Mapping Advisory :

- Child User Registration Process on ICEGATE 2.0 :

- eSanchit Application Process Guide :

- OFFICIAL WEBSITE >> ICE GATE Portal >> icegate.gov.in